BTC Price Prediction: Analyzing Investment Potential Amid Market Crosscurrents

#BTC

- Technical indicators show Bitcoin trading below key moving averages with bearish MACD momentum

- Mixed fundamental landscape with strong institutional adoption but current price pressure

- Long-term adoption trajectory remains positive despite short-term volatility concerns

BTC Price Prediction

BTC Technical Analysis: Current Market Position and Indicators

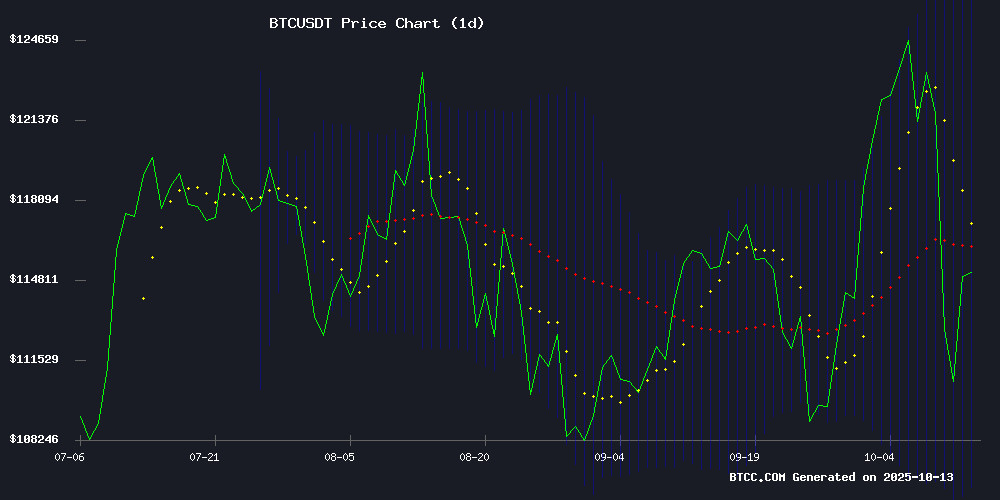

According to BTCC financial analyst Michael, Bitcoin is currently trading at $114,654.86, below its 20-day moving average of $116,666.39, indicating potential short-term weakness. The MACD reading of -3914.83 shows bearish momentum, while Bitcoin is trading near the middle Bollinger Band, suggesting the asset is at a critical technical juncture. Michael notes that a break above the 20-day MA could signal renewed bullish momentum.

Mixed Market Sentiment Amid Institutional Adoption and Price Volatility

BTCC financial analyst Michael observes that recent news presents a complex picture for Bitcoin. Positive developments include Maestro's enterprise bitcoin indexer launch and Block's zero-fee Bitcoin payments expansion, which support long-term adoption. However, Michael cautions that current price action testing support below $120,000 and the 'baffling downward swings' mentioned in headlines create near-term uncertainty. The mixed signals between institutional growth and price correction require careful monitoring.

Factors Influencing BTC's Price

Maestro Launches Symphony, an Audited Bitcoin Indexer for Enterprise Financial Applications

Bitcoin's financial infrastructure takes a leap forward with Maestro's introduction of Symphony, the first fully audited, open-source indexer built for enterprise-scale operations. The high-performance solution processes billions of transactions while supporting critical metaprotocols like BRC-20s, runes, and ordinals.

Symphony's open-source release on GitHub provides developers with battle-tested infrastructure to accelerate BitcoinFi adoption. "This unlocks sophisticated financial services directly on Bitcoin's decentralized network," said Marvin Bertin, CEO of Maestro. The indexer specifically enables lending platforms, stablecoins, and real-world asset tokenization.

The audited architecture addresses enterprise reliability concerns that have hindered institutional adoption. By combining security verification with open accessibility, Symphony bridges the gap between Bitcoin's core protocol and advanced financial applications.

Block Inc. Expands Square Platform with Zero-Fee Bitcoin Payments for Merchants

Block Inc. (NYSE: SQ) is integrating Bitcoin deeper into its Square platform, enabling merchants to accept zero-fee Bitcoin payments and automate conversions between fiat and crypto. The move targets small businesses seeking seamless digital asset adoption without third-party intermediaries.

The new feature eliminates processing fees for Bitcoin transactions, lowering barriers for merchants operating on thin margins. Automated fiat-to-Bitcoin conversion within the Square ecosystem further simplifies treasury management, allowing businesses to accumulate BTC reserves natively.

This expansion reflects Block's broader strategy to bridge traditional finance and digital assets. By embedding cryptocurrency tools directly into merchant financial workflows, the company positions Bitcoin as a practical payment rail rather than a speculative asset.

Bitcoin's Potential Surge: Experts Foresee Increased Investment Fueling Future Gains

Bitcoin stands at the threshold of a monumental rally as financial analysts highlight a perfect storm of bullish catalysts. Steadfast fundamentals, fading altcoin appeal, and growing conviction in its long-term value proposition are converging to potentially rewrite crypto market history.

Market sentiment has turned decisively optimistic since October 12, 2025, with institutional interest and regulatory clarity creating fertile ground for capital inflows. Samson Mow, a prominent crypto strategist, predicts this cycle could dwarf previous bull markets as Bitcoin's ecosystem maturity attracts serious investment.

Bitcoin Correction Deepens as Key Support Levels Tested Below $120K

Bitcoin's recent downturn intensified as prices breached critical support levels, fueling concerns among traders. The cryptocurrency slipped below $124,000 after failing to sustain momentum above $125,000, signaling heightened bearish pressure. A drop to $119,810 underscored the fragility of the current market structure.

Technical indicators point to further weakness, with the 100-hour Simple Moving Average now acting as resistance near $121,500. A descending trendline at $122,750 compounds the selling pressure, creating a clear hurdle for any recovery attempt. Market participants are closely watching Fibonacci levels and previous support zones for signs of stabilization.

The path to recovery appears challenging, with multiple resistance clusters between $121,750 and $124,000. A decisive break above $122,250 - the 61.8% retracement of the recent decline - could signal shifting momentum. However, the absence of strong buying interest suggests the correction may have further to run before establishing a durable bottom.

Tether CEO Affirms Bitcoin and Gold as Enduring Stores of Value

Tether CEO Paolo Ardoino declared on X that Bitcoin and gold will outlast any other currency, reinforcing the stablecoin issuer's strategic allocation to both assets. The company has consistently allocated up to 15% of net realized operating profits to Bitcoin since May 2023, framing it as a long-term balance sheet strengthener rather than direct backing for USDT.

Gold remains a parallel pillar in Tether's reserve strategy, with its Tether Gold (XAUt) token backed by over 7.66 tons of physical metal as of mid-2025. The firm has reportedly explored investments across the gold value chain, from mining to royalties, as part of broader diversification efforts.

Ardoino has previously grouped Bitcoin, gold, and land as key hedges, dismissing speculation about reducing BTC holdings for gold accumulation. The latest statement reaffirms Tether's dual commitment to both assets as enduring stores of value.

Bitcoin’s Baffling Downward Swings

Despite geopolitical tensions like the Sino-American trade war, bitcoin continues to attract institutional endorsement. Morgan Stanley now permits all clients—including retirement accounts—to allocate up to 4% of their portfolios to bitcoin, expanding access beyond high-net-worth individuals. The move signals deepening mainstream acceptance.

Russia’s central bank has greenlit private banks to offer bitcoin services, while Luxembourg’s sovereign fund and State Street predict accelerated institutional adoption. State Street forecasts a doubling of institutional bitcoin investments within three years, echoing last week’s European bank report projecting bitcoin’s inclusion in central bank reserves by 2030.

Bitcoin Retests Golden Cross as Analysts Eye $160K Rally

Bitcoin stands at a pivotal technical juncture, retesting the golden cross—a bullish signal where the 50-day moving average surpasses the 200-day average. Historical precedents suggest this formation often precedes major rallies, with gains ranging from 1,190% to 2,200% in prior cycles.

Analysts highlight the significance of holding above this crossover level. "If sustained, BTC could explode toward $160,000 by late 2025," says crypto analyst Mister Crypto, citing bullish MACD indicators and robust ETF inflows as catalysts. Institutional participation and technical alignment reinforce long-term optimism.

The market watches closely. Past golden crosses in 2019 and 2021 saw initial pullbacks before parabolic surges—a pattern that may repeat if current support holds.

Bitcoin Eyes $125,000 Target Amid Mixed Market Signals

Bitcoin's price trajectory shows potential for a rally to the $125,000-$130,000 range by mid-October 2025, despite bearish technical indicators. Analysts remain cautiously optimistic, with CoinCodex projecting a 10.27% surge to $128,269 within five days.

Support and resistance levels frame the current trading range, with $102,000 acting as immediate support and $126,199 posing strong overhead resistance. The market appears to be in a re-accumulation phase, with wedge patterns suggesting an impending breakout.

Diverging analyst views reflect the market's uncertainty. While AMB Crypto aligns with the $125,000 target, CryptoQuant's AI model predicts continued range-bound action between $108,000 and $123,000. Technical formations nonetheless hint at upward potential.

Pentagon's $1B Critical Minerals Stockpile Shakes Markets, Including Crypto

The U.S. Defense Department is making an unprecedented $1 billion bet on critical minerals, from rare earths to lithium, in a bold move to break China's supply chain dominance. The strategic pivot mirrors Cold War-era stockpiling—only this time, the commodities powering electric vehicles, semiconductors, and advanced weapon systems are at stake.

China's recent export restrictions on strategic materials sent shockwaves through global markets, including cryptocurrencies. Bitcoin and other digital assets felt the tremor as geopolitical tensions escalated. Donald Trump amplified the alarm on Truth Social, framing China's actions as economic hostility.

This isn't just about physical commodities. The Pentagon's stockpiling spree underscores a broader truth: supply chain security is now inseparable from national security. When rare earths for missile guidance systems become contested resources, even decentralized assets like crypto aren't immune to the fallout.

Coinbase and American Express to Launch Bitcoin-Themed Credit Card

Coinbase is set to introduce a Bitcoin-centric American Express credit card in the U.S. this fall, targeting Bitcoin purists with design and rewards that reflect the cryptocurrency's decentralized ethos. The move signals a strategic push to deepen engagement with the Bitcoin community amid growing institutional adoption.

Unlike conventional crypto cards focused on cashback or token incentives, this offering emphasizes Bitcoin's cultural and historical significance. Visual and conceptual elements will reportedly celebrate Bitcoin's origin story, appealing to enthusiasts who value its foundational principles.

Details on reward structures remain undisclosed, with specifics expected closer to the launch date. The collaboration positions Coinbase at the intersection of traditional finance and crypto culture, capitalizing on renewed mainstream interest in Bitcoin.

Ukrainian Crypto Trader Found Dead Amid Historic Market Collapse

Konstantin Galich, a prominent Ukrainian crypto trader known as Kostya Kudo, was found dead in Kyiv on October 11, 2025. The 32-year-old was discovered in his Lamborghini with a gunshot wound to the head, alongside a registered firearm. Initial reports suggest suicide, though authorities are investigating potential foul play.

Galich's death coincided with one of crypto's most brutal market crashes, where over $19 billion in derivatives positions were liquidated within 24 hours. Bitcoin led the plunge, erasing months of leveraged gains in seconds. His Telegram channel, followed by 68,000 subscribers, confirmed the tragedy after he left farewell messages citing financial and emotional distress.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents both opportunities and risks for investors. The current price of $114,654.86 sits below key technical levels, with the MACD indicating bearish momentum. However, ongoing institutional adoption through platforms like Square's zero-fee payments and enterprise tools like Maestro's indexer provide strong fundamental support.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $114,654.86 | Below 20-day MA |

| 20-day Moving Average | $116,666.39 | Resistance level |

| MACD | -3914.83 | Bearish momentum |

| Bollinger Band Position | Near Middle Band | Neutral territory |

Michael suggests that while short-term volatility may continue, the long-term adoption trajectory remains positive. Investors should consider their risk tolerance and investment horizon when evaluating Bitcoin's current position.